-

Our training courses

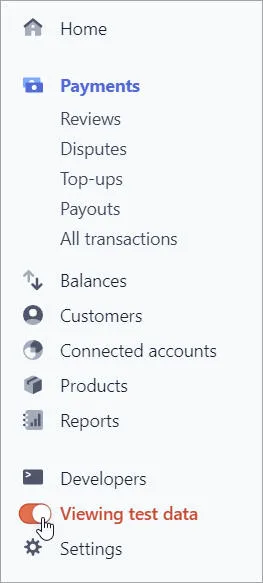

SQL courses and SQL Server training SQL training Reporting Services Integration Services SSAS Introduction to SQL Advanced SQL Fast track SQL Introduction to MySQL Reporting Services Advanced SSRS Fast track SSRS Report Builder Introduction to SSIS Advanced SSIS Fast track SSIS SSAS - Tabular Model Power Platform Training Pure Power BI DAX and fast-track Power Automate Power Apps Introduction to Power BI Adv. Power BI Reports Adv. Power BI Data Writing M for Power Query DAX for Power BI Fast track Power BI Fast track Power BI/DAX Power Automate Desktop Basic Power Automate Advanced Power Automate Fast track Power Automate Power Apps Excel (and 365) Training Standard Excel Specialist Excel VBA Macros Microsoft 365 Excel Introduction Excel Intermediate Excel Advanced Power Query for Excel Excel Business Modelling Power Pivot for Excel Excel VBA macros Advanced VBA Fast track Excel VBA Using Microsoft 365 Office scripts Programming and AI Visual C# training Python training AI training Introduction to Visual C# Intermediate C# Fast track C# Introduction to Python Advanced Python Fast track Python Prompt engineering Using AI tools Using the OpenAI API Copilot Studio agents You can see a calendar showing our current course schedule here. -

Other training resources

Free resources

Read our blogs, tips and tutorials

Try our exercises or test your skills

Watch our tutorial videos or shorts

Take a self-paced course

Read our recent newsletters

Paid servicesLicense our courseware

Book expert consultancy

Buy our publications

Getting helpGet help in using our site

- Our training venues

-

Why we are different

Transparent reviews

417 attributed reviews in the last 3 years

Delivery of coursesRefreshingly small course sizes

Outstandingly good courseware

Whizzy online classrooms

Wise Owl trainers only (no freelancers)

Nicer to work withAlmost no cancellations

We have genuine integrity

We invoice after training

Reliable and establishedReview 30+ years of Wise Owl

View our top 100 clients

-

Search our website

GO -

+44 (161) 883 3606 sales@wiseowl.co.uk Web enquiry form We also send out useful tips in a monthly email newsletter ...